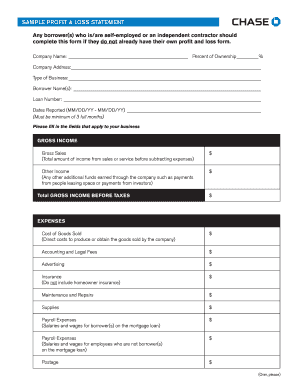

Get the free real estate agent profit and loss statement template

Show details

Good Real Estate Group (International) Limited International GAAP Illustrative financial statements for the year ended 31 December 2012 Based on International Financial Reporting Standards in issue

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign real estate agent profit and loss statement form

Edit your how to fill out real estate agent profit 06 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your real estate profit and loss statement template excel form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit profit and loss statement for real estate agents online

To use our professional PDF editor, follow these steps:

1

Log in to account. Click Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit realtor profit and loss statement form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out real estate profit and loss statement pdf form

How to fill out real estate agent profit:

01

Gather all necessary financial documents, such as income statements, expense records, and receipts.

02

Calculate the total revenue earned from real estate transactions conducted during the specific period.

03

Deduct any applicable expenses, such as advertising costs, property maintenance expenses, professional fees, and office rent.

04

Calculate the net profit by subtracting the total expenses from the total revenue.

05

Fill out the real estate agent profit form, which usually requires inputting the net profit, along with other relevant financial information.

06

Double-check all entries for accuracy and completeness before submitting the form.

Who needs real estate agent profit?

01

Real estate agents who are self-employed or work on commission basis are required to keep track of their profit for taxation purposes.

02

Real estate agencies or brokerages may also request the profit information from agents as part of their financial reporting.

03

Potential investors or business partners may also be interested in reviewing the profit of a real estate agent before entering into any financial agreements.

Fill

profit and loss statement real estate

: Try Risk Free

What is real estate agent profit?

Since real estate agents are typically independent contractors, no taxes are withheld from their pay by the brokers for whom they work. ... Any broker who pays an agent $600 or more during the year must file IRS Form 1099-MISC with the IRS. The form is also filed with the applicable state tax agency.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my real estate profit and loss statement excel in Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign profit and loss statement for real estate and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How do I execute real estate profit and loss statement template online?

Easy online real estate profit and loss template completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

Can I edit real estate profit and loss statement on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign real estate income statement template right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

What is real estate agent profit?

Real estate agent profit refers to the earnings generated by a real estate agent after deducting all expenses related to their business activities, including commissions from property sales and operational costs.

Who is required to file real estate agent profit?

Real estate agents who earn income through commissions and other real estate-related activities are typically required to file real estate agent profit, often during tax season to report their earnings.

How to fill out real estate agent profit?

To fill out real estate agent profit, agents need to gather their income information, deduct applicable business expenses, and report the net profit on their tax forms following IRS guidelines or local tax requirements.

What is the purpose of real estate agent profit?

The purpose of reporting real estate agent profit is to accurately calculate taxable income, comply with tax regulations, and provide transparency regarding an agent's earnings for financial records.

What information must be reported on real estate agent profit?

Information that must be reported includes total income earned from commissions, any deductions for business expenses, specific expenses related to marketing, training, and other operational costs.

Fill out your real estate agent profit online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Real Estate P L Template is not the form you're looking for?Search for another form here.

Keywords relevant to how to fill out real estate agent realtor profit and form for accuracy before submission

Related to real estate p l template excel

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.